Trusted and secured by leading authorities

Financial Services at a Breaking Point

Customer expectations and rapid technology advancement are fueling banking transformation.

Customer Demands are Changing

75% of banks say it is more challenging to win and retain customers than it was 12 months ago.

Businesses Can’t Keep up With the Pace

44% of companies have already experienced AI output going wrong. Additionally, over 50% of C-suite executives say AI programs are taking too long to complete or realize value.

95% of AI Agents Fail

44% of companies have already experienced AI output going wrong. Additionally, over 50% of C-suite executives say AI programs are taking too long to complete or realize value.

GetVocal Transforms Financial Service

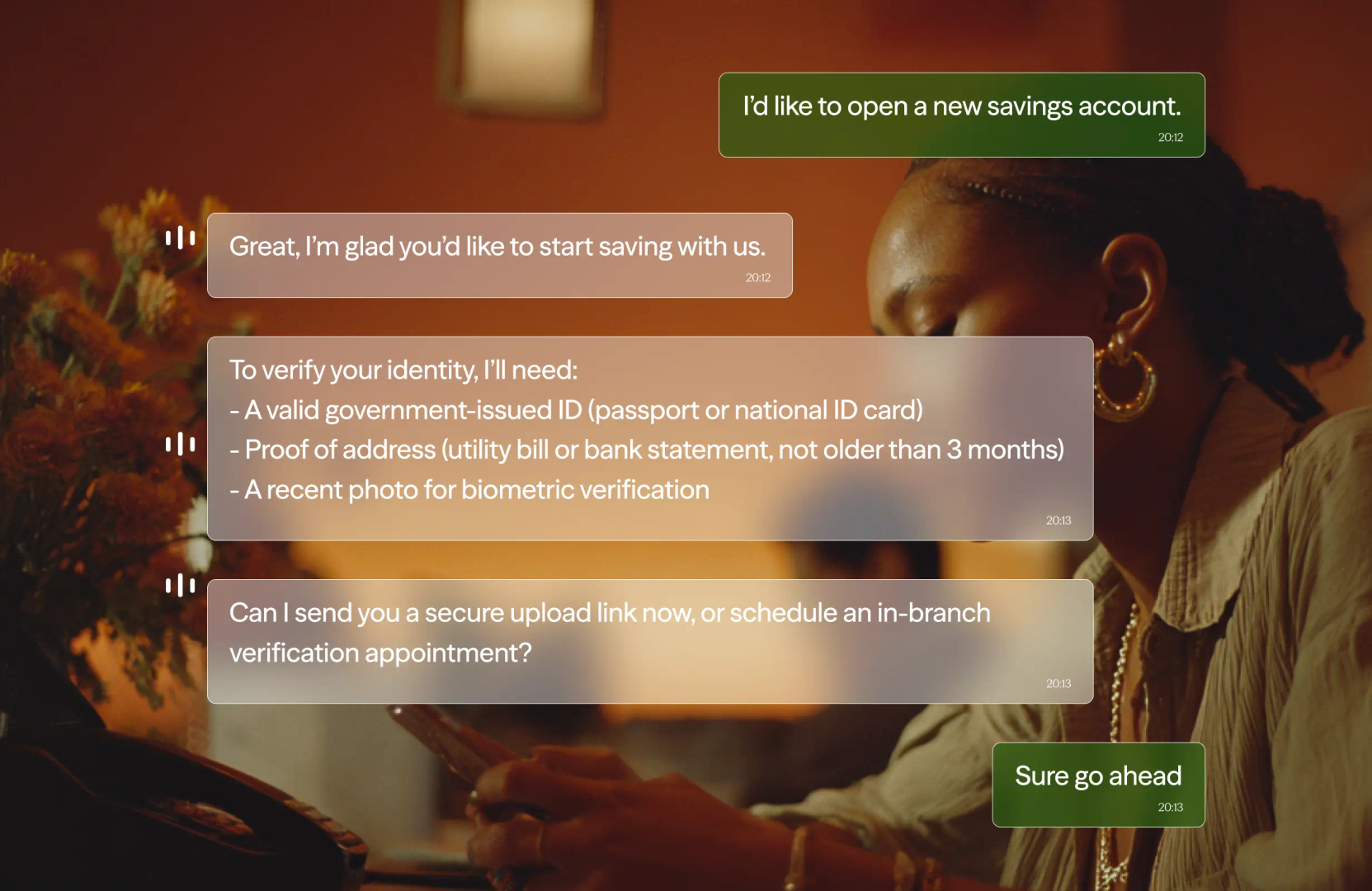

AI that securely verifies customer identity, documents, and compliance requirements at scale.

AI Agents Built for Seamless and Compliant High-Stakes Conversations

Not all AI agents are created equal, and many are built on flawed foundations. GetVocal is designed from the ground up for hybrid human-AI collaboration, combining real-time human oversight with deterministic AI to ensure precise, protocol-driven conversations and seamless handoffs to human agents when needed.

Bring Your Own Agent

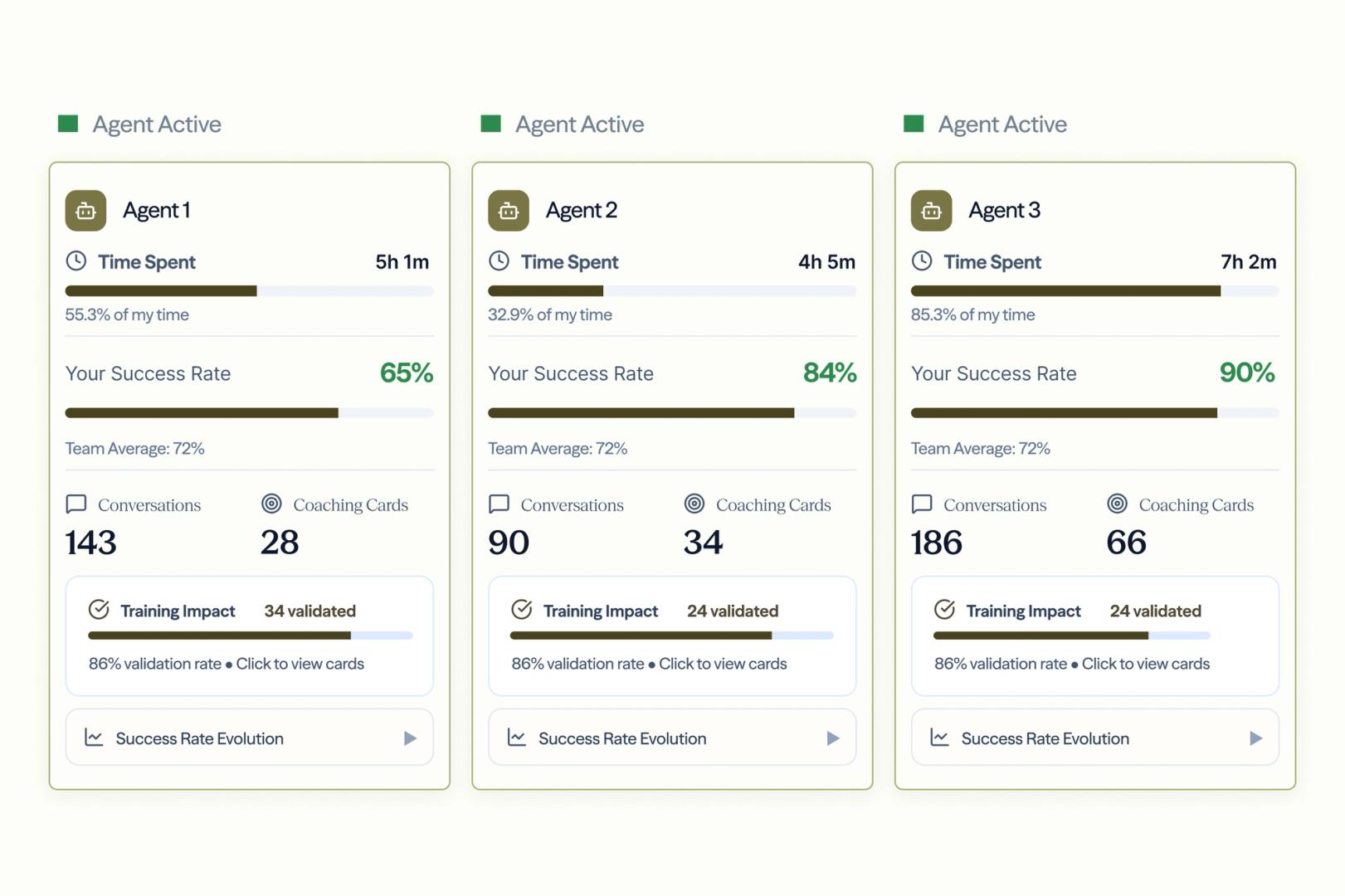

Manage all your human and AI agents in one place, no matter where they are from.

Science-Driven Agent Learning

Agent improvement is scientific, incremental, and human-coached.

Unite All Agents in One Place

Manage all your human and AI agents in real-time in one Hybrid Workforce Platform.

Banking and Finance with GetVocal: by the Numbers

- 78%Higher Connection Rates

- 49%Containment

- 100%Auditability and Compliance

Automating Loan Application & Account Support for a European Retail Bank

GetVocal deployed AI voice and chat agents focused on the top three high-volume use cases across the credit union's customer service operations. These included handling loan application status inquiries, providing detailed product and rate information to members, and managing branch appointment booking requests.

The customer service team was overwhelmed by repetitive calls like “What’s the status of my loan application?” These queries made up over 55% of inbound volume, driving long wait times and flat costs.

Host It Your Way: Your Data, Your Rules

GetVocal enables financial institutions to deploy AI agents securely behind the firewall or in a compliant cloud hosting environment, ensuring data sovereignty and operational simplicity. GetVocal meets GDPR and SOC 2 standards out of the box and is engineered for full alignment with the EU AI Act.

Perfect Match with Your Existing Tech Stack

GetVocal integrates effortlessly with your banking systems, CRMs, and contact centers. With hundreds of pre-built connections, it seamlessly integrates into your stack, so AI agents activate quickly and scale as new systems come online.

Launch within a few weeks

Launch agents quickly with rapid iterations, and extend their capabilities gradually.

Choose an Operating Model

Start simple with one process. Build fully self-serve with our intuitive builder, speed up your work using our templates, or rely on our Agent Deployment Team for a turnkey launch.

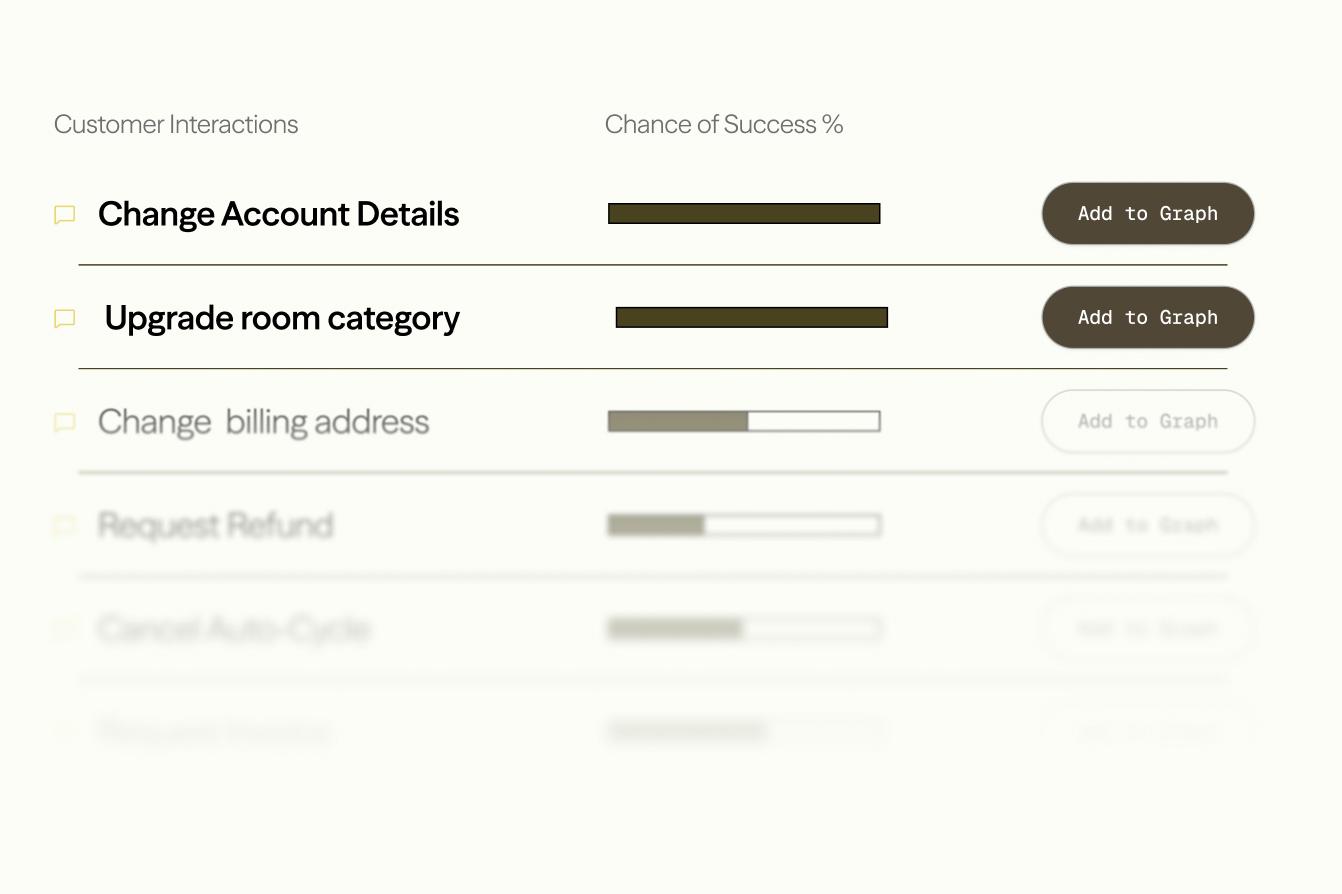

Pinpoint the Use Cases

We help you identify the first high-value conversations where AI can deliver immediate impact. This becomes your baseline from which the Agent Context Graph will evolve.

Launch and Optimize

We help you identify the first high-value conversations where AI can deliver immediate impact. This becomes your baseline from which the Agent Context Graph will evolve.

Scale AI Agents

Go from one agent to a full fleet covering 90%+ of your customer conversations. Expand across functions, channels, and regions without relying on developers.

Spain’s largest telecom operator using two-way human-AI workforce

Resolve up to 2x More Cases. Handle Requests 3x Faster.

We challenge your existing setup and prove improvement with real numbers. No-risk engagement, outcome-based pricing. With our value-based pricing, you pay for the results we deliver, not for licenses or unpredictable consumption.